Description

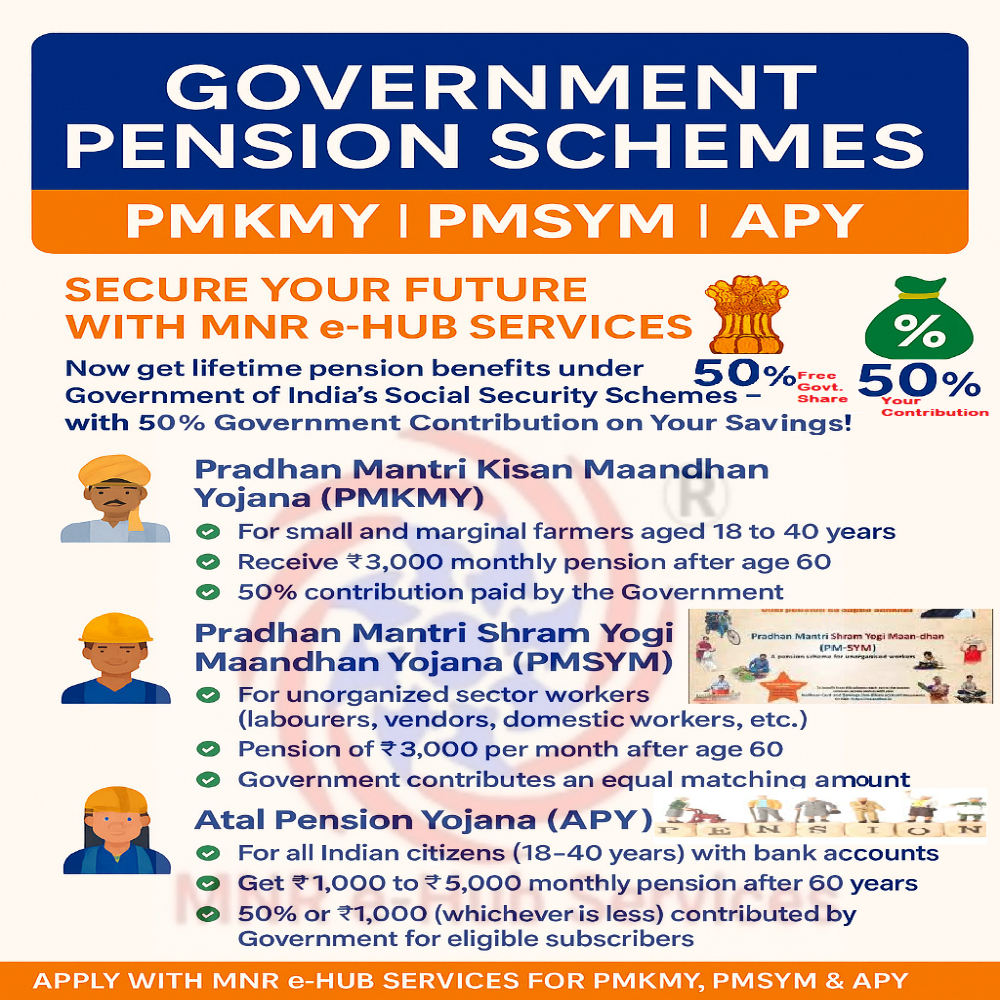

1) Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM) — Pension for Unorganised Workers

Headline / short description

PM-SYM is a voluntary contributory pension scheme for unorganised sector workers — eligible subscribers make a small age-based monthly contribution and receive an assured ₹3,000/month pension after they turn 60. Maandhan+1

Who is eligible

-

Unorganised workers (street vendors, domestic workers, construction workers, small artisans, fishermen, rickshaw drivers, etc.).

-

Entry age: 18–40 years.

-

Monthly income usually up to ₹15,000 (self-declared).

-

Not covered under EPF/ESIC/NPS and not an income-tax payer. Maandhan+1

What subscriber pays (price / contribution)

-

Monthly contribution depends on age at entry — the older you join, the higher the monthly amount. The Central Government matches your contribution 50:50. See the official contribution chart for exact amounts by age. Example illustrative entry amounts: ₹55–₹200+ per month depending on age. (Exact chart at Maandhan official site.) Maandhan+1

How to apply (practical steps)

-

Visit a Common Service Centre (CSC) nearest you or a designated enrolment point / MNR e-Hub centre. Online enrolment often routes through CSC/Digital Seva. Digit Insurance+1

-

Provide Aadhaar, bank/Jan-Dhan account details (with IFSC) and mobile number (Aadhaar-linked preferred).

-

Complete Aadhaar OTP verification and pay the first contribution (often collected at enrolment). The govt will set up auto-debit for future monthly contributions from the bank account. Ministry of Labour & Employment

Documents required

-

Aadhaar card (mandatory)

-

Savings bank / Jan Dhan account number + IFSC (for auto-debit)

-

Mobile number (preferably Aadhaar-linked)

-

Nominee details (recommended)

-

Optional: passport photo, evidence of occupation (if available). Ministry of Labour & Employment

Processing time / expectation

-

Usually same day / immediate acknowledgement after Aadhaar OTP & first payment. If Aadhaar/mobile mismatches occur, verification may take longer. Ministry of Labour & Employment

Suggested MNR assistance fee (what you charge customers)

-

₹99 – ₹249 (₹99 for simple online guidance; ₹199–₹249 for in-shop assistance including OTP help and first payment collection).

Short FAQs

-

Is there a govt fee? — No registration fee; subscriber contributes monthly as per the chart; government matches contributions. Ministry of Labour & Employment

-

When will pension start? — From age 60 subject to scheme rules and continuous contributions. Ministry of Labour & Employment

Legal / disclaimer

MNR only assists with enrolment. Final eligibility, UMID/acknowledgement and benefits are governed by official PM-SYM rules and processing by the designated authorities. Ministry of Labour & Employment

2) Pradhan Mantri Kisan Maan-Dhan Yojana (PMKMY) — Pension for Small & Marginal Farmers

Headline / short description

PMKMY is a voluntary contributory pension scheme for small & marginal farmers that provides an assured ₹3,000/month pension on attaining 60 years, with a small age-based monthly contribution from the farmer. PM KMY+1

Who is eligible

-

Small & marginal farmers aged 18–40 years.

-

Ownership of cultivable land up to 2 hectares (as per land records) — eligibility rules may be state-specific. PM KMY+1

What subscriber pays (price / contribution)

-

Monthly contribution varies by age at entry. The contribution is modest (examples similar to other Maandhan schemes) and continues until age 60. Exact contribution table and entry-age mapping are available on the PMKMY portal. The scheme provides government support matching/structure per official rules. PM KMY+1

How to apply (practical steps)

-

Visit the nearest Common Service Centre (CSC), designated PMKMY registration point or the PMKMY portal. CSCs generally handle the entire process for farmers. Common Services Centres+1

-

Provide Aadhaar, bank account details (for auto-debit), proof of landholding (as needed), mobile number and nominee details.

-

Complete Aadhaar OTP verification and pay the first contribution; future contributions are usually auto-debited. PM KMY

Documents required

-

Aadhaar card (mandatory)

-

Savings bank account / Jan Dhan account details with IFSC (for auto-debit)

-

Land ownership / cultivable land proof (as per state records)

-

Mobile number (Aadhaar-linked preferred)

-

Nominee details (recommended). PM KMY+1

Processing time / expectation

-

Usually immediate / same day on successful Aadhaar OTP & first payment at CSC. If land records or Aadhaar linking require correction, processing may take longer.

Suggested MNR assistance fee

-

₹99 – ₹299 depending on whether you assist with land proof/document collection and bank auto-debit setup.

Short FAQs

-

Is PMKMY free? — The pension itself is funded by the contributions; enrolment has no govt fee, but contributions are payable by the subscriber; MNR charges a small service fee for assistance. PM KMY

Legal / disclaimer

Final confirmation & pension benefits are subject to scheme rules and verification by the relevant government agencies; MNR only assists with registration and documentation. PM KMY

3) Atal Pension Yojana (APY) — Guaranteed Pension (₹1,000–₹5,000)

Headline / short description

APY is a government pension scheme for all citizens (primarily intended for workers in the unorganised sector) that guarantees a monthly pension ranging from ₹1,000 to ₹5,000 after age 60, depending on the contribution chosen and the subscriber’s entry age. Jan Suraksha+1

Who is eligible

-

Savings bank account holders aged 18–40 years (some variants allow different ranges for new joiners).

-

Not an income-tax payer (but eligibility is broader now — check bank/NSDL guidance). APY can be joined at bank branches, through the bank’s APY registration process or digitally. NSDL NPS CRA+1

What subscriber pays (price / contribution)

-

Contribution tables are pension-and-age dependent. Example: to get ₹1,000–₹5,000 pension, fixed contribution amounts (monthly/quarterly/half-yearly) are prescribed by table — see APY official contribution chart (NSDL / NPSCRATrust PDF) for exact numbers. The contribution increases with older entry age and higher target pension. NSDL NPS CRA+1

How to apply (practical steps)

-

Approach your bank branch that holds your savings account or use the bank’s APY online registration portal (many banks and the eNPS/APY portal support digital enrolment). Protean eGov Technologies+1

-

Fill the APY registration form, provide Aadhaar / bank account details and choose your desired pension slab (₹1,000 / ₹2,000 / ₹3,000 / ₹4,000 / ₹5,000).

-

Set up periodic contributions (auto-debit from savings account monthly/quarterly/half-yearly). Ensure Aadhaar is linked to the mobile for OTP verification if required. Jan Suraksha+1

Documents required

-

Aadhaar card / Aadhaar Virtual ID / Aadhaar-seeded mobile number (for eKYC/OTP)

-

Savings bank account number with IFSC (contributions auto-debited)

-

PAN (if required by bank; but APY typically targets non-income tax payers)

-

Nominee details. NSDL NPS CRA+1

Processing time / expectation

-

Enrolment normally completes same day / within a few days depending on bank verification and KYC. APY pays pension from age 60 assuming continuous contributions. Jan Suraksha

Suggested MNR assistance fee

-

₹99 – ₹249 depending on whether you set up auto-debit, do Aadhaar linkage help, or complete branch formalities for the customer.

Short FAQs

-

What pension amounts are available? — ₹1,000, ₹2,000, ₹3,000, ₹4,000 or ₹5,000 per month (subscriber picks at enrolment and contributes accordingly). Exact contribution amounts depend on entry age. Jan Suraksha

-

What if I stop contributing? — APY has exit/withdrawal rules; partial withdrawals and exit provisions depend on tenure and circumstances — check APY rules. Jan Suraksha

Legal / disclaimer

APY administration and payouts are governed by the PFRDA/NPS/NSDL rules; MNR only assists with enrolment and documentation. Verify details and the contribution chart on official APY resources before enrolment.