Description

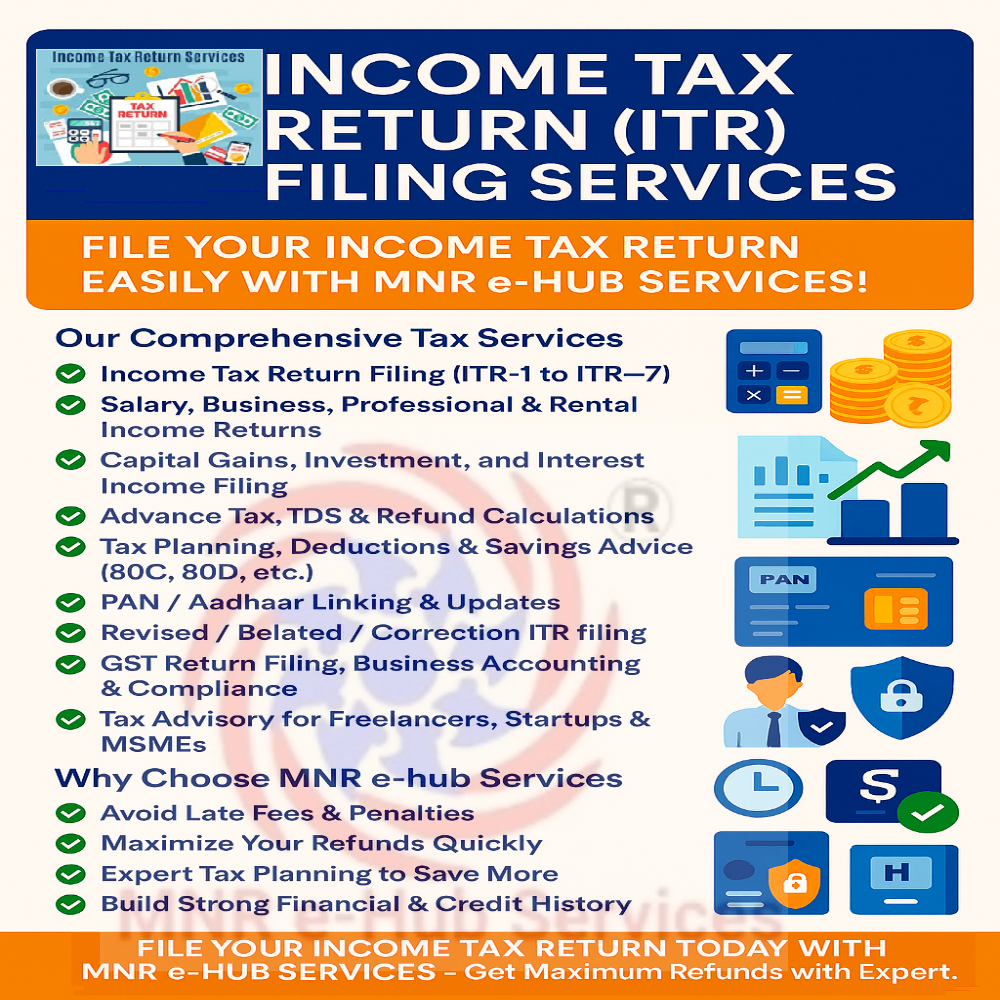

Get expert assistance for tax returns, GST registration & filing, TDS, ITR, and compliance tasks. Pay ₹99 as our service fee (non-refundable) — we handle data entry, calculation, form preparation & final submission. Government fees / penalties / taxes are paid separately.

Why choose this service?

-

Avoid errors and rejections — expert filing ensures accuracy

-

Affordable entry: low service fee to engage clients

-

Transparent pricing: you’ll see govt charges before final submission

-

End-to-end support: we prepare, review and file your tax forms

Pricing Model

-

Service fee (non-refundable): ₹99 — this is what you pay to engage our services

-

Additional charges (to be paid before final submission):

-

Government fees / statutory charges / interest / late fees (if applicable)

-

Penalties or additional taxes (if your case demands)

-

-

Example: For GST filing, ₹99 + actual GST late fee if applicable; for ITR return, ₹99 + tax amount / processing charges.

Note: The ₹99 is non-refundable since we allocate human resources to parse your documents. The government charges are only collected when your forms are ready to be submitted (you approve them first).

Who can use this service?

-

Individuals (salaried, self-employed) for ITR filing

-

Small business owners or shopkeepers needing GST registration / monthly/quarterly GST returns

-

Businesses needing TDS filing, compliance, audits, penalty assessment & rectification

-

Anyone needing simplified taxation help without navigating portals themselves

Documents / information required

| Category | What to provide | Notes |

|---|---|---|

| Personal & identity | PAN card, Aadhaar, bank account statements, bank passbook, PAN-Aadhaar linkage | To verify identity and income sources |

| Income proof | Salary slips, Form 16, Form 26AS, 80C deductions, interest statements, rent receipts etc. | Helps compute taxable income |

| Business/GST | Business PAN / GSTIN, sales & purchase invoices, expense bills, previous GST returns (if any) | For GST compliance / registration |

| TDS / other taxes | Form 16B, TDS certificates, proof of tax deduction, tax payment challans | For accurate TDS filings |

| Financial statements | Balance sheet, P&L (if business) | For business owners with accounting records |

We will also ask for your contact details (mobile & email) and consent to file on your behalf.

How to apply / process flow

-

Click Book Taxation Service (₹99)

-

Fill a short application form (name, PAN, contact, type of service)

-

Upload scanned documents (identity, income, business, invoices etc.)

-

Our tax expert reviews your info → clarifies via call or message if needed

-

We prepare tax forms (ITR / GST / TDS) and present you the summary & breakdown including government charges

-

You approve the final version and pay the government / statutory charges

-

We submit forms to the government / tax portal and send you the acknowledgement (ITR-V / GST receipt, etc.)

Estimated turnaround time

-

Simple ITR / salaried returns: 1–2 business days

-

Business / GST / complex filings: 3–5 business days

-

Rectifications / amendments: 2–4 days depending on scope

FAQs (frequently asked questions)

Q: Why is the ₹99 non-refundable?

A: Because we allocate time and begin document review and preparation immediately. Even if you cancel later, work begins.

Q: Will I have to pay more than ₹99?

A: Yes — government fees, taxes, penalties, interest (if applicable) are extra and only paid when you approve final submission.

Q: Is this service legal & safe?

A: Yes — all filing is made under your PAN / name. You receive drafts for review and must approve before submission. We maintain data privacy.

Q: What if my documents are incomplete?

A: We’ll notify you and guide which missing documents or information to submit; final processing waits until you provide them.

Q: Can I request revision / appeal later?

A: Yes, we offer support for amendments / appeals as a separate service (charged accordingly).

Legal & Compliance note

MNR e-Hub acts as a facilitator / tax preparer on your behalf. Final submissions to income tax / GST / tax authorities are done in your name and under your PAN / credentials. MNR is not liable for penalties or rejections due to incorrect or fraudulent information provided by you. Verify all data carefully before authorizing submission. Always keep a copy of the filed return / acknowledgement.